Jackie took two units of wood out of storage, placed them on the workbench and started a job card, which is a form that she will use to track direct and indirect costs of the project. She labels Parboteeah’s order as “Job 1” and will track it from now on that way. Below we have listed a chart that shows a variety of common jobs and whether they should be classified as direct or indirect labor. Indirect labor pertains to any employee whose role is not crucial to the direct development of a product, a job, or a service but indirectly contributes to it. It further includes factory workers directly engaged in the assembly line, such as product manufacturers, packing personnel, machine operators, and quality checkers, for example, in a manufacturing organization. Stated again for clarity, this expense refers to salaries, wages, and benefits paid to workers directly involved in performing a service or manufacturing a product.

Accounting for Manufacturing Overhead

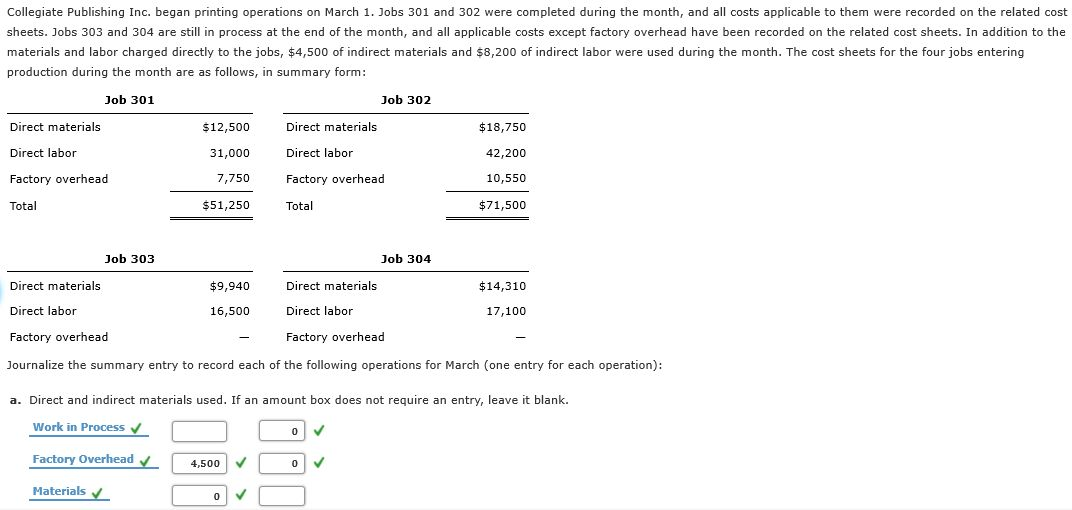

You are deciding whether to purchase a pizza franchise or open your own restaurant specializing in pizza. List the expenses necessary to sell pizza and identify them as a fixed cost or variable cost; as a manufacturing cost or sales and administrative costs; and as a direct materials, direct labor, or overhead. For each overhead item, state whether it is an indirect material expense, indirect labor expense, or other. Job order costing requires the assignment of direct materials, direct labor, and overhead to each production unit.

Calculating the Predetermined Overhead Rate

These employees are not categorized as direct labor workers because they are ordinarily not responsible to set up, run or maintain any production process. In this journal entry, the labor cost that includes both the direct labor and indirect will need to be assigned to appropriate manufacturing accounts later on. In a service environment, direct labor rates can be recorded directly on a per-job basis. Lawyers, consultants, and others are often required to track their billable hours so that the direct labor cost can be passed directly to the customer. One major issue in all of these contracts is adding too much overhead cost and fraudulent invoicing for unused materials or unperformed work by subcontractors.

Video Illustration 2-2: Computing an organization-wide predetermined manufacturing overhead rate LO3

Read our direct labor rate and time standards article to understand how organizations establish these two direct labor standards. From the following information, let us understand how to calculate the direct labor cost of the company for the month ending on September 30, 2019. This unique component of the Sling software allows you to keep track of your labor budget and receive alerts when you’re about to exceed those numbers.

Once you have the total cost, the direct labor rate is calculated by dividing that dollar amount by the total hours of labor calculated earlier. In the manufacturing example, some workers may have special skills that command a higher salary, while others could be unskilled and less expensive. In both cases, it’s important to calculate the total aggregate expense for all the workers directly involved, accounting for the variances in their pay, benefits, and taxes to ensure an accurate total cost.

Recording the application of overhead costs to a job is further illustrated in the T- accounts that follow. The processes to solve the following scenario are demonstrated in Video Illustration 2-5 below. In the fabrication department, laborers quantity in math definition uses and examples video and lesson transcript pour composite materials into custom carved molds. In finishing, the widgets are put on an automated production line where they are heated and coated. Suppose, you’re an experienced attorney who employs a receptionist and a trainee assistant.

The accounting terms of debit and credit are used to identify the increases and decreases made to each account during the process. A summary of the accounting equation and the accounting rules of debit and credit are provided in Exhibit 2-1 below. Additionally, the flow of costs in a job-order costing system is demonstrated in Video Illustration 2-1. Once a product is sold, it is no longer an asset in the organization’s possession. At that point, the costs to manufacture the product are moved from the Finished Goods inventory asset account to the Cost of Goods Sold account.

- To account for these and inform managers making decisions, the costs are tracked in a cost accounting system.

- The Direct Labor Cost is classified as product cost, inventory cost, prime cost, or a conversion cost (in case of manufacturing overhead allocation).

- Examples of typical overhead costs are production facility electricity, warehouse rent, and depreciation of equipment.

- If the actual overheadexceeds the applied overhead, they may wish to learn why the actualoverhead is so high.

- Direct labor costs are included in the company’s inventory accounts until the goods are sold.

A standard job cost sheet records all direct material, direct labor, and manufacturing overhead costs applied to a job. Typically, a job cost sheet also records the total costs, the number of units, the cost per unit, as well as the selling price for each job. When this journal entry is recorded, we also record overhead applied on the appropriate job cost sheet, just as we did with direct materials and direct labor.

Production used $13,500 of direct material and worked 21 direct labor hours at a rate of $20 per hour. In order to set an appropriate sales price for a product, companies need to know how much it costs to produce an item. Just as a company provides financial statement information to external stakeholders for decision-making, they must provide costing information to internal managerial decision makers.

The Manufacturing Overhead inventory account is used to record actual manufacturing overhead costs incurred to produce a product. Marshal company’s standard direct labor rate is $5 per hour and a unit of its product takes 2 hours to complete. Compute the standard direct labor cost of the company if it produced 5,000 units during the month of July 2022. In job order costing, the company can transfer the cost of direct labor to the work in process inventory and the cost of indirect labor to the manufacturing overhead. Direct labor rates are the labor costs directly resulting in the production of a product or delivery of a service. These costs include wages, payroll taxes, insurance, retirement matches, and other benefit costs.