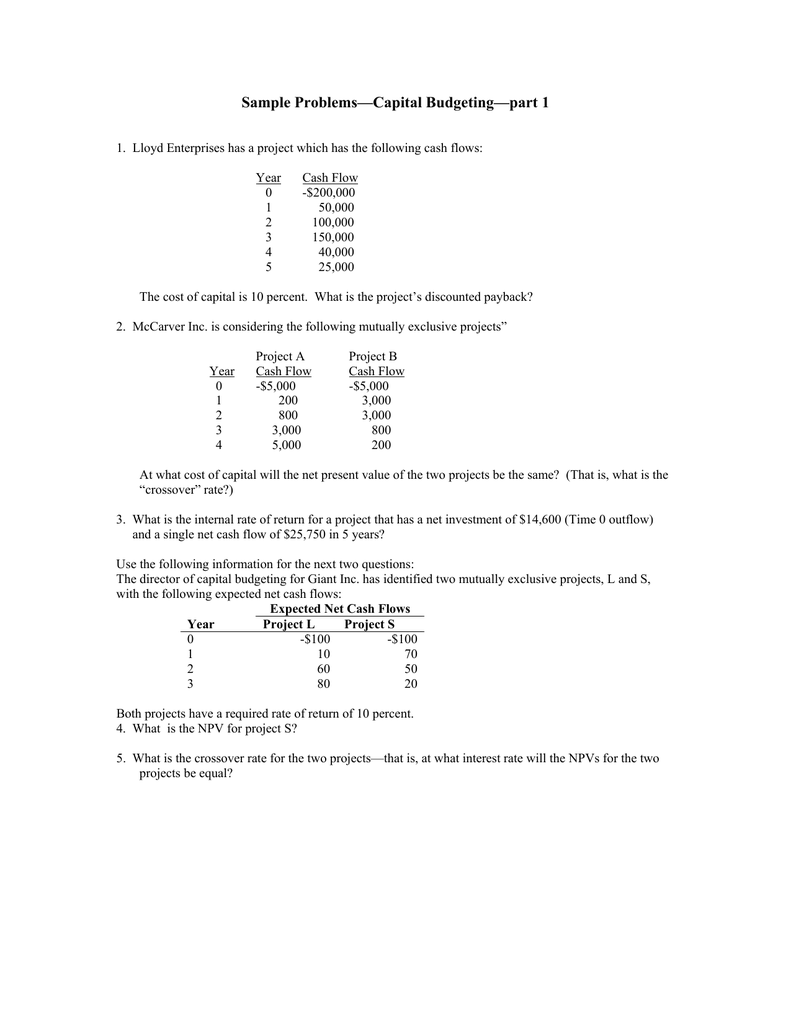

Most organizations have limited resources and more potential capital projects than they can fund. For this reason, managers must be able to evaluate the alternatives and select the project that offers the most benefit to the organization. The ability to choose appropriate learn how long to keep tax records capital investments is an essential component of an organization’s long-term financial health and stability. The uncertainty of the capital budgeting decisions may be with reference to the cost of the project; future expected returns from the project, etc.

Organization

Instead, it is the expense used to allocate the cost of a long-term asset over a period of time. Since the payback method uses annual net cash inflow, depreciation is not considered for this calculation. If net operating income is given, depreciation expense must be added back to arrive at annual net cash inflow. The average rate of return means the average rate of return or profit taken for considering the project evaluation.

Factors Affecting the Working Capital

The discounted cash flows are then netted together to produce the investment’s net present value. Capital budgeting problems often involve irreversible and long-term commitments that may limit the ability of the organization to adapt and respond to changing circumstances and opportunities. Therefore, it is beneficial to incorporate real options and flexibility into the capital budgeting process, as they can enhance the value and performance of the projects. Real options are opportunities to modify, expand, contract, defer, or abandon the projects in the future, depending on the market conditions and the strategic objectives of the organization. Flexibility is the capacity to adjust the scale, scope, timing, and execution of the projects in response to new information and uncertainties. In such cases, the decision-maker should recognize and value the real options and flexibility embedded in the project, and factor them into the capital budgeting decision.

Timeframe For Capital Budgeting Projects

Early-stage ideation and strategic initiatives will typically originate in the capital budgeting process. Approved and carry-forward projects will be reflected in the project portfolio management, financial and capital budgeting systems. While not all projects are capital in nature, and not all capital investments are project-based, project portfolio management and capital budgeting are deeply entwined. Some of the key similarities and differences between project portfolio management and capital budgeting process are considered below.

A finance manager may also face difficulties in measuring the cost and benefits of a project in quantitative terms. Still, efforts should be made to examine the effects of the factors, and proper adjustments be done in evaluating investment proposals. The future is always uncertain, Risk is embedded in its veins. Ranking different investment proposals in order of priority will help management in taking appropriate decisions, particularly when there is a financial constraint. Investments lead to being unable to utilize assets or overutilization of fixed assets. Therefore, before making the investment, it is required careful planning and analysis of the project thoroughly.

Analytical Delays and Data Expiry Risks

Capital evaluation is essential for making sound financial decisions and avoiding common pitfalls and challenges in capital budgeting. In this section, we will discuss some of the effective techniques for capital evaluation and how they can help us overcome the difficulties and uncertainties in capital budgeting. We will also provide some examples to illustrate the application of these techniques.

- Additionally, this method only considers the initial investment and the annual net cash inflows.

- The profitability index (PI) is calculated by dividing the present value of future cash flows by the initial investment.

- Sensitivity analysis tests how changes in one factor affect the project.

- However, they are interdependent in that each project will perform better if both are produced.

- At the end of the day, capital budgeting can be a particularly helpful mechanism for deciding which capital projects to pursue—and which to put on pause.

However, if the Threshold Rate of Return would be 10%, then it would be rejected as the IRR would be lower. In that case, the company will choose Project B which shows a higher IRR as compared to the Threshold Rate of Return. This brings the enterprise to conclude that Product B has a shorter payback period and therefore, it will invest in Product B.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.