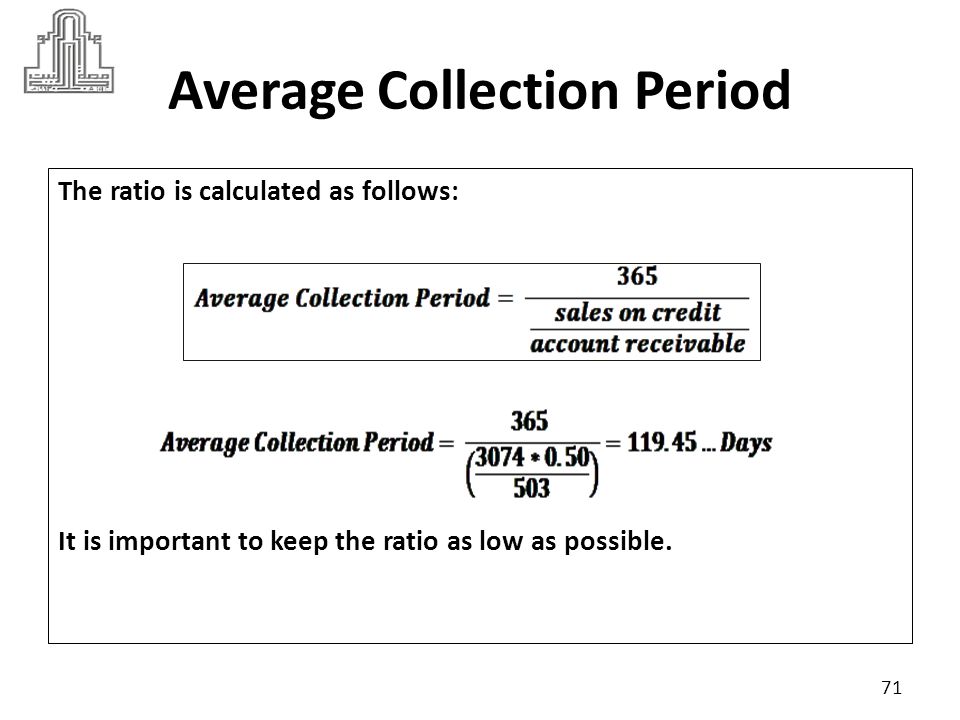

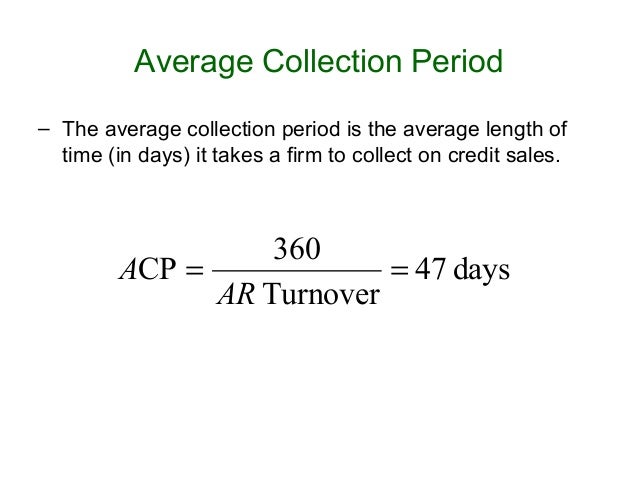

You have to divide a company’s average accounts receivable balance by the net credit sales and then multiply the quotient into 365 days. First, gather the net credit sales and average accounts receivable for the period. To ensure accurate analysis, it is crucial to calculate both ACP and CCC consistently, using comparable time frames and accounting standards. By doing so, businesses can effectively measure their performance trends and identify opportunities for improvement in their AR management practices and overall cash flow conversion processes. Comparing your organization’s industry benchmarks helps determine whether its average collection period is within a reasonable range.

Step 1: Understand the Receivables Turnover Ratio

The average accounts receivable is determined by taking the sum of the beginning and ending balances, then dividing that amount by two. Net credit sales are calculated as total sales made on credit minus any discounts or returns during the same period. The average collection period is an accounting metric used to represent the average number of days between a credit sale date and the date when the purchaser remits payment. A company’s average collection period is indicative of the effectiveness of its AR management practices. Businesses must be able to manage their average collection period to operate smoothly. The money that these entities owe to a business when they purchase products or services is recorded on a company’s balance sheet, under accounts receivable or AR.

How to calculate your average collection period: formula and example

Companies use this key performance indicator (KPI) to manage their cash flows effectively, understand their liquidity position, and measure the efficiency of their accounts receivable management practices. In essence, it represents the average number of days between recording a credit sale and receiving payment from clients. Average collection period refers to the amount of time it takes for a business to receive payments owed by its clients in terms of accounts receivable (AR). Companies use the average collection period to make sure they have enough cash on hand to meet their financial obligations. The average collection period is an indicator of the effectiveness of a firm’s AR management practices and is an important metric for companies that rely heavily on receivables for their cash flows. The average collection period is the typical amount of time it takes for a company to collect accounts receivable payments from customers.

A Projected Cash Flow

The cash conversion cycle indicates how long it takes for a company to convert its inventories into sales, collect those receivables, pay off its accounts payable, and ultimately generate net free cash flow. CCC is calculated as the sum of the average collection period and the inventory turnover period (days to sell inventory). Understanding both ACP and CCC together can provide valuable insights into a company’s working capital management and overall financial health. Understanding industry benchmarks and comparisons is vital in evaluating the performance of an organization’s average collection period.

- It may mean that your business isn’t efficient enough when it comes to staying on top of collecting its accounts receivable.

- This not only improves cash flow but also fosters positive relationships with your clients.

- The average collection period is the average number of days it takes to collect payments from your customers.

Regularly review your policy and adjust it as needed based on changes in your business environment or market conditions. By interpreting your organization’s average collection period, you can make informed decisions regarding collections policies, customer relationships, and the overall financial health of your business. Stay tuned for our next section on the benefits of maintaining a low average collection period. 💡 You can also use the same method to calculate your average collection period for a particular day by dividing your average amount of receivables by your total credit sales of that day. If this company’s average collection period was longer—say, more than 60 days— then it would need to adopt a more aggressive collection policy to shorten that time frame. Otherwise, it may find itself falling short when it comes to paying its own debts.

What Is Average Collection Period? – Formula and How to Calculate It

Every company monitors this period and tries to keep it as short as possible so that the receivables do not remain blocked for a long time. The best average collection period is about balancing between your business’s credit terms and your accounts receivables. In general, a higher receivable turnover is better because it means customers pay their invoices what are the risks of an accounting career on time. So Light Up Electric should compare its AR Turnover Ratio to the industry average to see how they’re doing. The longer a receivable goes unpaid, the less likely you are to be able to collect from that customer. In this article, we’ll show you how to calculate your company’s average collection period and give you some examples of how to use it.

It increases the cash inflow and proves the efficiency of company management in managing its clients. An organization that can collect payments faster or on time has strong collection practices and also has loyal customers. However, it also means that they follow a very strict collection procedure which may also drive away customers because they prefer suppliers who have more flexible credit terms. The average collection period is the average number of days it takes for a credit sale to be collected.

However, it can also show that your credit policy is one that offers more flexible credit terms. According to the Bank for Canadian Entrepreneurs (BDC), most businesses should have an average collection period of less than 60 days. However, the ideal number depends on the nature of your business, client relationships, and invoice period. Offer Multiple Payment MethodsProviding clients with multiple payment options can make it easier and more convenient for them to pay on time. Offering electronic payment methods, such as credit cards, ACH transfers, or e-checks, allows customers to pay faster while reducing your processing times.

The average collection period can be used to evaluate competitors’ performance. This offers more depth into what other businesses are doing and how a business’s operations stack up. Delays in payment from more clients may indicate that receivables are at risk of being uncollected, which should be closely monitored as an early warning sign of bad allowances. Overall, the average collection period is a valuable indicator for evaluating a company’s short-term financial health. By understanding the factors influencing this metric and implementing best practices, companies can improve their collections efficiency and enhance their overall financial position.

It refers to how quickly the customers who bought goods on credit can pay back the supplier. The earlier the supplier gets the funds, the better it is for business because this fund is a huge source of liquidity. In addition, it can be readily used to make short-term payments or obligations.

If the accounts receivable collection period is more extended than expected, this could indicate that customers don’t pay on time. It’s a good idea to review your balance sheet and credit terms to improve collection efforts. Companies should review their average collection period regularly, ideally monthly or quarterly, to quickly identify and address any potential issues in credit policies, collections processes, or cash flow.